Medicare Advantage provides comprehensive healthcare benefits to millions of Americans. With America approaching a demographic turning point, this program has become even more important. Learn more about the benefits of Medicare Advantage.

What is Medicare Advantage?

For more than 20 years, the Medicare Advantage (MA) program has been integral to the Medicare guarantee. In 2025, MA provides comprehensive healthcare benefits for 34.1 million seniors and people with disabilities who choose the program, 54% of the Medicare population.1 MA plans are designed to promote the types of preventative care and chronic disease management that keep seniors healthy. The savings generated through care coordination are reinvested into lowering beneficiaries’ premiums and out-of-pocket costs and providing supplemental benefits. On average, MA seniors save

Humana has served Medicare beneficiaries for decades, with approximately 5.2 million members enrolled in a MA plan, as of September 30, 2025. In 2026, Humana has MA plan offerings in 46 states and Washington, D.C., covering 85% of U.S. counties. New plan types will be available in four states and 177 counties.

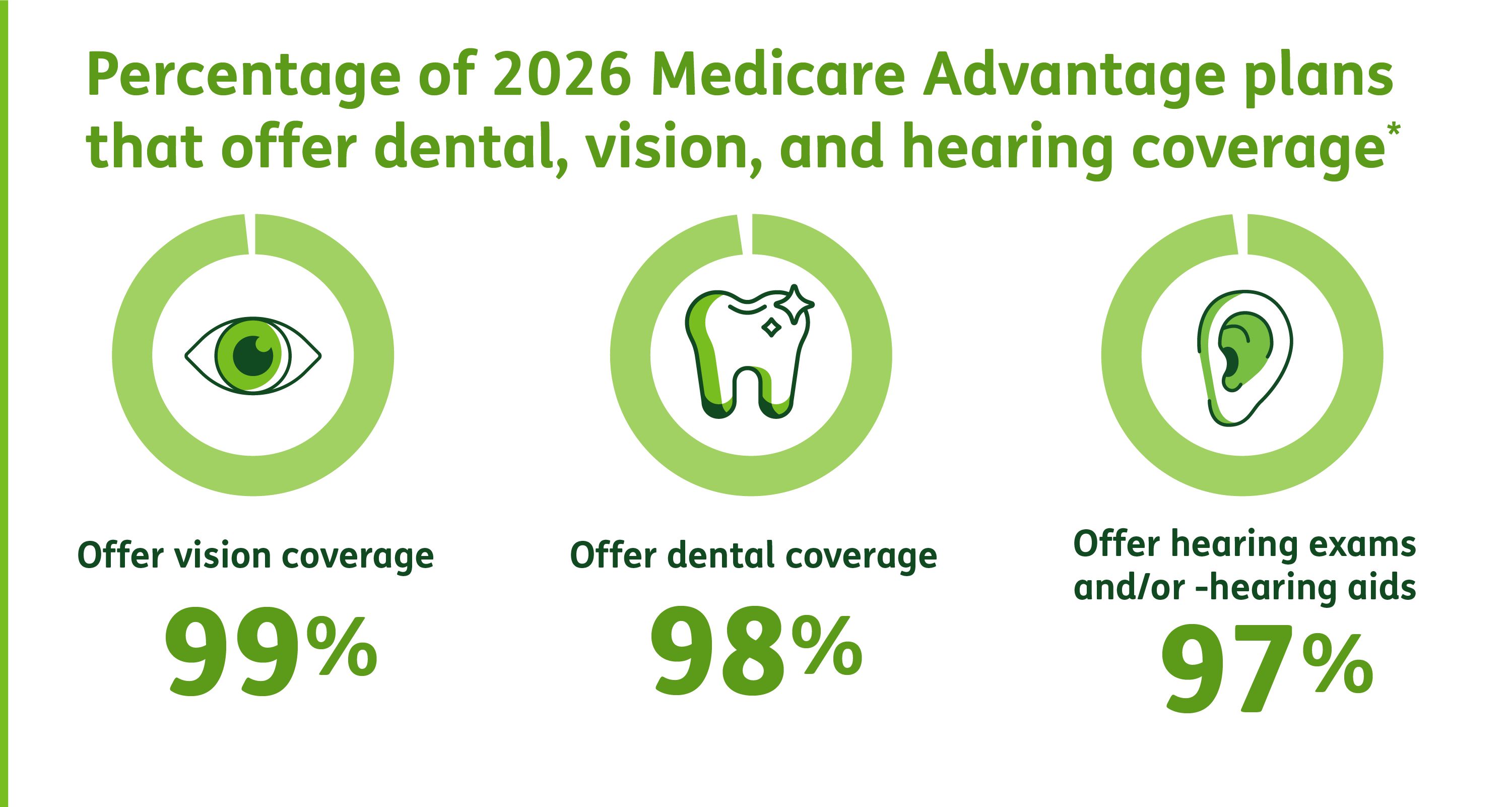

More Supplemental Benefits

Under MA, health plans cover the same services as fee-for-service (FFS) Medicare, but they also include coverage of additional supplemental benefits such as prescription drugs, dental, vision, hearing, and more – all while capping out-of-pocket costs. The savings generated through care coordination in the MA program are reinvested into lowering beneficiaries’ premiums and out-of-pocket costs and providing supplemental benefits such as dental, vision, hearing, meals, and transportation. Medicare Advantage premiums are at a 17-year low of $17/month2. With a limit on out-of-pocket costs and often Part D prescription drug coverage included, MA plans deliver cost-effective, high-quality coverage for today’s seniors–while covering all services provided under FFS Medicare.

1 KFF Medicare Advantage in 2025:

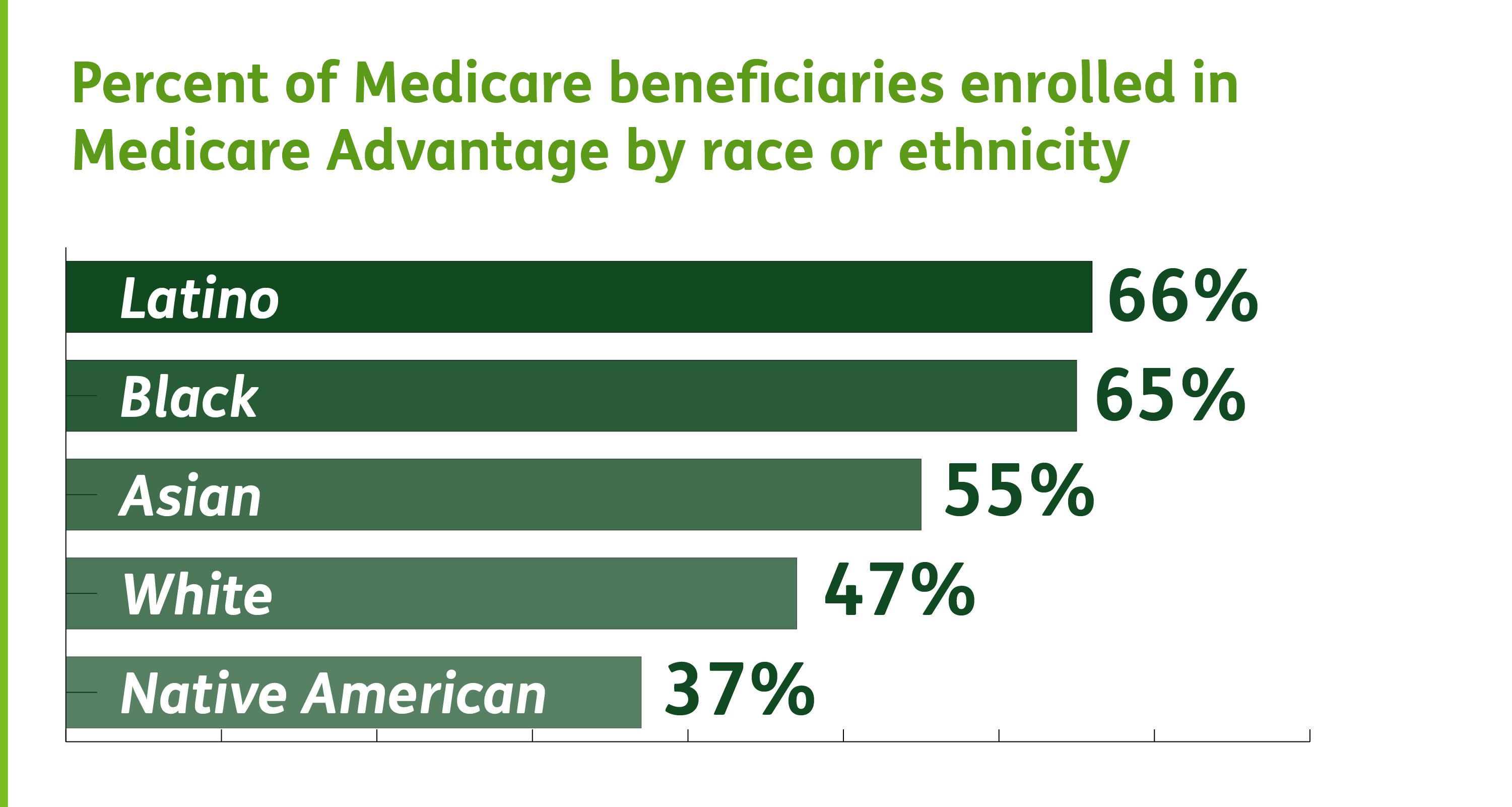

Minorities Disproportionately Rely Upon MA

MA is the preferred option for Black and Latino beneficiaries compared to FFS Medicare. This is especially true in rural areas, where MA enrollees are nearly three times as likely to be Black and more likely to be Latino compared to FFS Medicare3. In addition, more than half of all MA beneficiaries have annual incomes below 200% of the federal poverty level (FPL), and 36% of Black beneficiaries and 35% of Latino beneficiaries in MA report being food insecure4.

3

4 Ibid

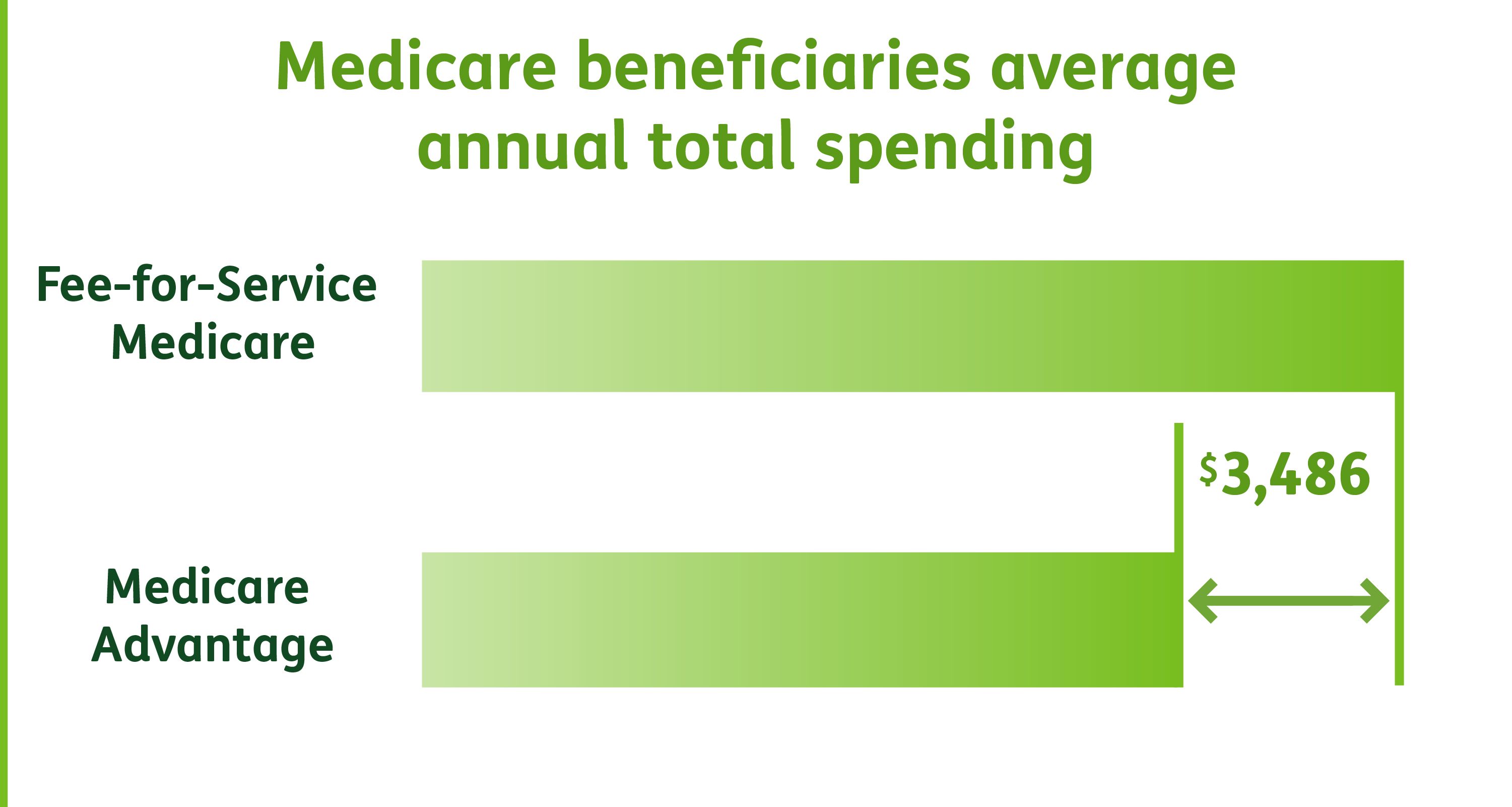

Keeping Costs Low

With more flexible coverage and plan design, and increased incentives to keep costs low and provide preventative care, the MA beneficiaries save an average of $3,486 annually compared to those in FFS Medicare5. MA beneficiaries with 3+ chronic conditions saved approximately $4,100 more than FFS beneficiaries6. MA plans are federally required to provide an out-of-pocket limit for services covered under Parts A and B, while FFS Medicare does not have out-of-pocket limits.7 In addition, 76% of enrollees pay $0 premium for their MA and Part D coverage.8

5 Analysis by ATI Advisory; “

6 Ibid

7 KFF: Medicare Advantage in 2025:

8 Ibid

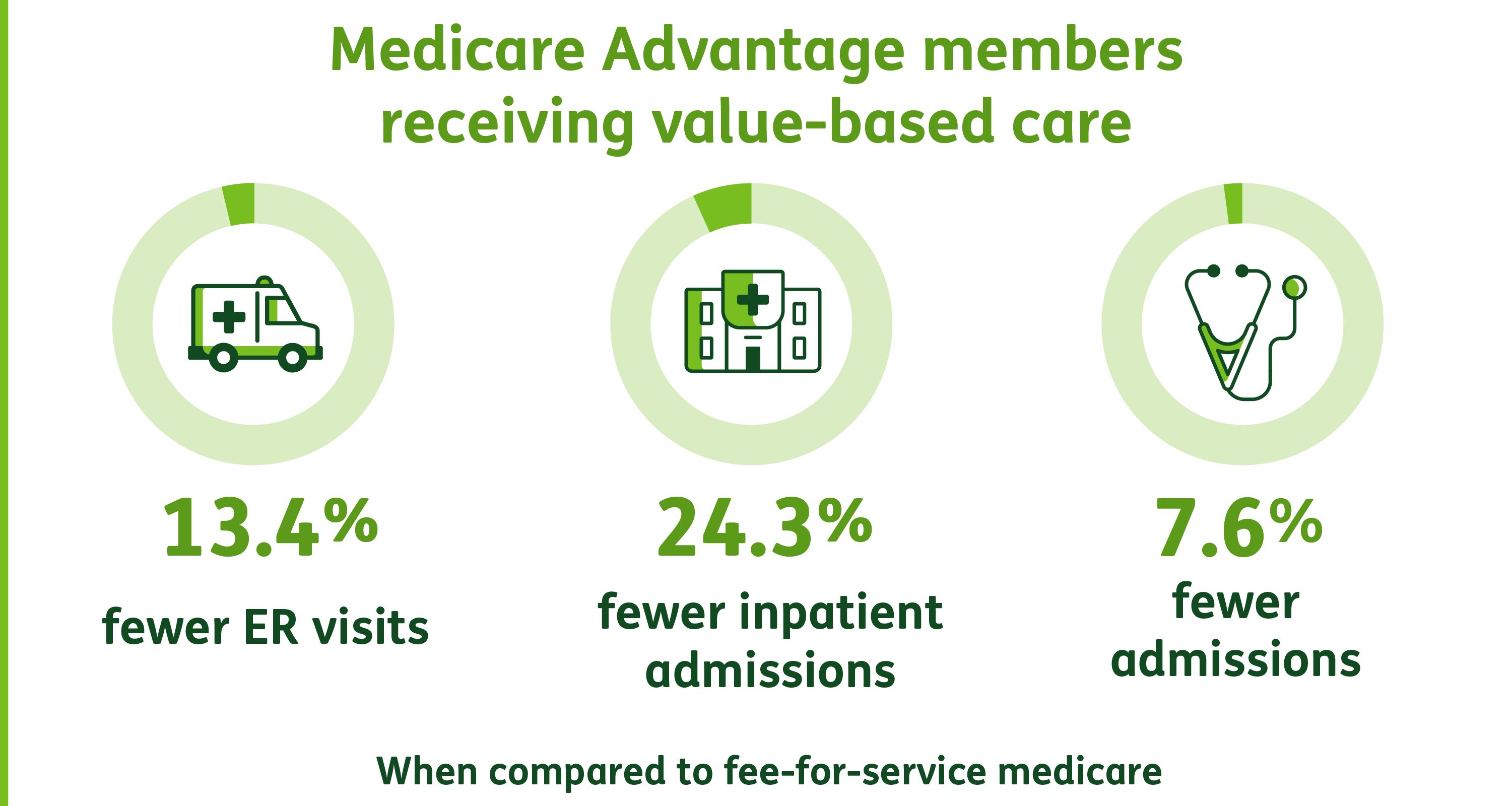

Better Quality Care

MA beneficiaries as a whole have more complex medical conditions compared to FFS Medicare. That's why there's an increased emphasis on more preventative care and better quality of care under MA. A study published in The New England Journal of Medicine Catalyst showed that patients who receive care from senior-focused primary care organizations are 37% more likely to experience highly continuous visits with their primary care physician. Moreover, MA beneficiaries experienced 24.3% fewer inpatient admissions and 13.4% fewer ER visits than those in FFS Medicare. MA beneficiaries also had a 43% lower rate of avoidable hospitalizations due compared to FFS Medicare.9 MA beneficiaries also have better outcomes for specific health conditions, such as prediabetes and diabetes, where MA patients were more likely to receive preventive care.10

9

10 Ibid

Making Drug Coverage Affordable

Nearly all MA plans offer prescription drug coverage with their plans and 98% of MA enrollees receive prescription drug coverage with their plans.11 In 2025, the average monthly premium for Part D prescription drug coverage was $17.12

11

12 Ibid